Page 128 - ICD AR21 EN

P. 128

NOTES TO THE FINANCIAL STATEMENTS FOR THE YEAR ENDED 31 DECEMBER 2021

(CONTINUED)

30 RISK MANAGEMENT (Continued)

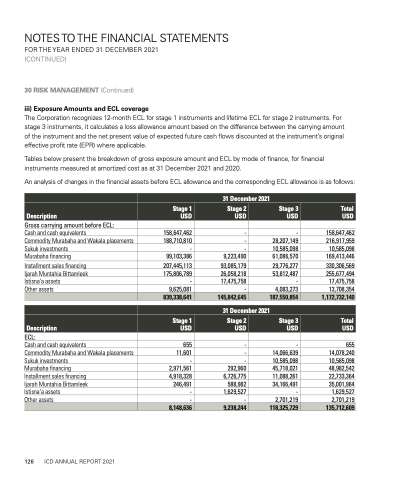

iii) Exposure Amounts and ECL coverage

The Corporation recognizes 12-month ECL for stage 1 instruments and lifetime ECL for stage 2 instruments. For stage 3 instruments, it calculates a loss allowance amount based on the difference between the carrying amount of the instrument and the net present value of expected future cash flows discounted at the instrument’s original effective profit rate (EPR) where applicable.

Tables below present the breakdown of gross exposure amount and ECL by mode of finance, for financial instruments measured at amortized cost as at 31 December 2021 and 2020.

An analysis of changes in the financial assets before ECL allowance and the corresponding ECL allowance is as follows:

31 December 2021

Description

Stage 1 USD

Stage 2 USD

Stage 3 USD

Total USD

Gross carrying amount before ECL:

Cash and cash equivalents

Commodity Murabaha and Wakala placements Sukuk investments

Murabaha financing

Installment sales financing Ijarah Muntahia Bittamleek Istisna’a assets

Other assets

ECL:

Cash and cash equivalents

Commodity Murabaha and Wakala placements Sukuk investments

Murabaha financing

Installment sales financing

Ijarah Muntahia Bittamleek

Istisna’a assets

Other assets

158,647,462 - 188,710,810 - - - 99,103,386 9,223,490

207,445,113 93,085,179 175,806,789 26,058,218 - 17,475,758 9,625,081 -

655 - 11,601 - - - 2,971,561 292,960 4,918,328 6,726,775 246,491 588,982 - 1,629,527 - -

- 28,207,149 10,585,098 61,086,570

29,776,277 53,812,487 - 4,083,273

- 14,066,639 10,585,098 45,718,021 11,088,261 34,166,491 - 2,701,219

158,647,462 216,917,959 10,585,098 169,413,446

330,306,569 255,677,494 17,475,758 13,708,354

655 14,078,240 10,585,098 48,982,542 22,733,364 35,001,964 1,629,527 2,701,219

839,338,641

145,842,645

187,550,854

1,172,732,140

31 December 2021

Description

Stage 1 USD

Stage 2 USD

Stage 3 USD

Total USD

8,148,636

9,238,244

118,325,729

135,712,609

126 ICD ANNUAL REPORT 2021