Page 104 - ICD AR21 EN

P. 104

NOTES TO THE FINANCIAL STATEMENTS FOR THE YEAR ENDED 31 DECEMBER 2021

(CONTINUED)

12 EQUITY INVESTMENTS (Continued)

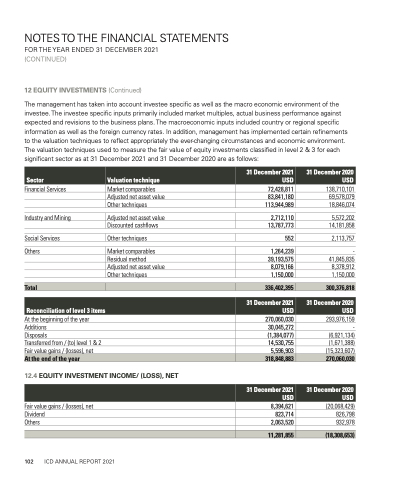

The management has taken into account investee specific as well as the macro economic environment of the investee. The investee specific inputs primarily included market multiples, actual business performance against expected and revisions to the business plans. The macroeconomic inputs included country or regional specific information as well as the foreign currency rates. In addition, management has implemented certain refinements to the valuation techniques to reflect appropriately the ever-changing circumstances and economic environment. The valuation techniques used to measure the fair value of equity investments classified in level 2 & 3 for each significant sector as at 31 December 2021 and 31 December 2020 are as follows:

Sector

Valuation technique

31 December 2021 USD

31 December 2020 USD

Financial Services

Industry and Mining

Social Services Others

Market comparables Adjusted net asset value Other techniques

Adjusted net asset value Discounted cashflows

Other techniques

Market comparables Residual method Adjusted net asset value Other techniques

72,428,811

83,841,180 113,944,989

2,712,110 13,787,773

138,710,101 69,578,079 18,846,074

5,572,202 14,181,858

552 2,113,757

1,264,239 - 39,193,575 41,845,835 8,079,166 8,378,912 1,150,000 1,150,000

270,060,030

Total

336,402,395

300,376,818

Reconciliation of level 3 items

31 December 2021 USD

31 December 2020 USD

At the beginning of the year

Additions 30,045,272

Disposals (1,384,077)

Transferred from / (to) level 1 & 2 14,530,755

Fair value gains / (losses), net 5,596,903 (15,323,607)

293,976,159 - (6,921,134) (1,671,388)

At the end of the year

318,848,883

270,060,030

12.4 EQUITY INVESTMENT INCOME/ (LOSS), NET

31 December 2021 USD

31 December 2020 USD

Fair value gains / (losses), net 8,394,621 Dividend 823,714 Others 2,063,520

(20,068,429) 826,798 932,978

11,281,855

(18,308,653)

102 ICD ANNUAL REPORT 2021