Page 105 - ICD AR21 EN

P. 105

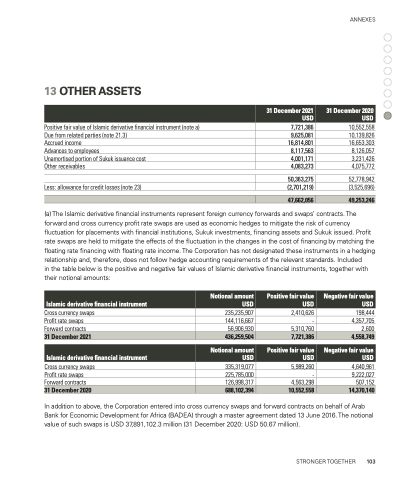

13 OTHER ASSETS

Positive fair value of Islamic derivative financial instrument (note a)

Due from related parties (note 21.3) Accrued income

Advances to employees

Unamortised portion of Sukuk issuance cost Other receivables

Less: allowance for credit losses (note 23)

7,721,386

9,625,081 16,814,801 8,117,563 4,001,171 4,083,273

50,363,275 (2,701,219)

10,552,558 10,139,826 16,653,303

8,126,057 3,231,426 4,075,772

52,778,942 (3,525,696)

ANNEXES

31 December 2021 USD

31 December 2020 USD

47,662,056

49,253,246

(a) The Islamic derivative financial instruments represent foreign currency forwards and swaps’ contracts. The forward and cross currency profit rate swaps are used as economic hedges to mitigate the risk of currency fluctuation for placements with financial institutions, Sukuk investments, financing assets and Sukuk issued. Profit rate swaps are held to mitigate the effects of the fluctuation in the changes in the cost of financing by matching the floating rate financing with floating rate income. The Corporation has not designated these instruments in a hedging relationship and, therefore, does not follow hedge accounting requirements of the relevant standards. Included

in the table below is the positive and negative fair values of Islamic derivative financial instruments, together with their notional amounts:

Islamic derivative financial instrument

Notional amount USD

Positive fair value USD

Negative fair value USD

Cross currency swaps

Profit rate swaps

Forward contracts 56,906,930 5,310,760 2,600

235,235,907 144,116,667

2,410,626 198,444 - 4,357,705

31 December 2021

436,259,504

7,721,386

4,558,749

Islamic derivative financial instrument

Notional amount USD

Positive fair value USD

Negative fair value USD

Cross currency swaps

Profit rate swaps

Forward contracts 126,998,317 4,563,298 507,152

In addition to above, the Corporation entered into cross currency swaps and forward contracts on behalf of Arab Bank for Economic Development for Africa (BADEA) through a master agreement dated 13 June 2016. The notional value of such swaps is USD 37,891,102.3 million (31 December 2020: USD 50.67 million).

335,319,077 225,785,000

5,989,260 4,640,961 - 9,222,027

31 December 2020

688,102,394

10,552,558

14,370,140

STRONGER TOGETHER 103