Page 107 - ICD AR21 EN

P. 107

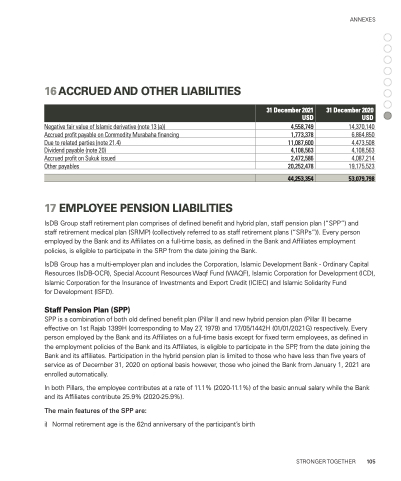

16 ACCRUED AND OTHER LIABILITIES Negative fair value of Islamic derivative (note 13 (a))

Accrued profit payable on Commodity Murabaha financing Due to related parties (note 21.4)

Dividend payable (note 20)

Accrued profit on Sukuk issued

Other payables

17 EMPLOYEE PENSION LIABILITIES

4,558,749

1,773,378 11,087,600 4,108,563 2,472,586 20,252,478

14,370,140 6,864,850 4,473,508 4,108,563 4,087,214

19,175,523

ANNEXES

31 December 2021 USD

31 December 2020 USD

44,253,354

53,079,798

IsDB Group staff retirement plan comprises of defined benefit and hybrid plan, staff pension plan (“SPP”) and staff retirement medical plan (SRMP) (collectively referred to as staff retirement plans (“SRPs”)). Every person employed by the Bank and its Affiliates on a full-time basis, as defined in the Bank and Affiliates employment policies, is eligible to participate in the SRP from the date joining the Bank.

IsDB Group has a multi-employer plan and includes the Corporation, Islamic Development Bank - Ordinary Capital Resources (IsDB-OCR), Special Account Resources Waqf Fund (WAQF), Islamic Corporation for Development (ICD), Islamic Corporation for the Insurance of Investments and Export Credit (ICIEC) and Islamic Solidarity Fund

for Development (ISFD).

Staff Pension Plan (SPP)

SPP is a combination of both old defined benefit plan (Pillar I) and new hybrid pension plan (Pillar II) became effective on 1st Rajab 1399H (corresponding to May 27, 1979) and 17/05/1442H (01/01/2021G) respectively. Every person employed by the Bank and its Affiliates on a full-time basis except for fixed term employees, as defined in the employment policies of the Bank and its Affiliates, is eligible to participate in the SPP, from the date joining the Bank and its affiliates. Participation in the hybrid pension plan is limited to those who have less than five years of service as of December 31, 2020 on optional basis however, those who joined the Bank from January 1, 2021 are enrolled automatically.

In both Pillars, the employee contributes at a rate of 11.1% (2020-11.1%) of the basic annual salary while the Bank and its Affiliates contribute 25.9% (2020-25.9%).

The main features of the SPP are:

i) Normal retirement age is the 62nd anniversary of the participant’s birth

STRONGER TOGETHER 105