Page 109 - ICD AR21 EN

P. 109

17 EMPLOYEE PENSION LIABILITIES (Continued)

Administration of SRPs

The Pension Committee appointed by the President of IsDB Group, administers SRPs as separate funds on behalf of its employees. The Pension Committee is responsible for the oversight of investment and actuarial activities of the SRPs. The SPP’s assets are invested in accordance with the policies set out by the Pension Committee. The Bank and its affiliates underwrite the investment and actuarial risk of the SRPs and share the administrative expenses.

Risks

Investment risk

The present value of the SRPs’ liability is calculated using a discount rate determined by reference to high quality corporate bond yields; if the return on SRPs’ asset is below this rate, it will create a plan deficit. Currently the SRPs’ have a relatively balanced investment in equity securities, debt instruments and real estate. Due to the long-term nature of the SRPs’ liabilities, the administrator of SRPs’ consider it appropriate that a reasonable portion of the SRPs’ assets should be invested in equity securities and in real estate to leverage the return generated by the fund.

Discount rate

A decrease in the bond return rate will increase the SRPs’ liability but this will be partially offset by an increase in the return on the SRPs’ debt investments.

Longevity risk

The present value of the SRPs’ liability is calculated by reference to the best estimate of the mortality of SRPs’ participants both during and after their employment. An increase in the life expectancy of the SRPs’ participants will increase the SRPs’ liability.

Salary risk

The present value of the SRPs’ liability is calculated by reference to the future salaries of SRPs’ participants. As such, an increase in the salary of the SRPs’ participants will increase the SRPS’ liability.

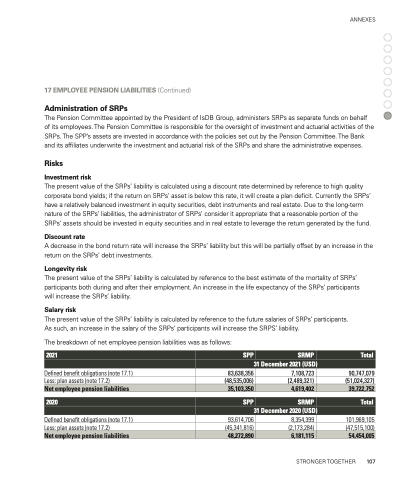

The breakdown of net employee pension liabilities was as follows:

Defined benefit obligations (note 17.1) Less: plan assets (note 17.2)

Defined benefit obligations (note 17.1) Less: plan assets (note 17.2)

7,108,723

83,638,356

(48,535,006) (2,489,321)

90,747,079 (51,024,327)

101,969,105 (47,515,100)

ANNEXES

2021

SPP

SRMP

Total

31 December 2021 (USD)

Net employee pension liabilities

35,103,350

4,619,402

39,722,752

2020

SPP

SRMP

Total

31 December 2020 (USD)

93,614,706

(45,341,816) (2,173,284)

8,354,399

Net employee pension liabilities

48,272,890

6,181,115

54,454,005

STRONGER TOGETHER 107