Page 110 - ICD AR21 EN

P. 110

NOTES TO THE FINANCIAL STATEMENTS FOR THE YEAR ENDED 31 DECEMBER 2021

(CONTINUED)

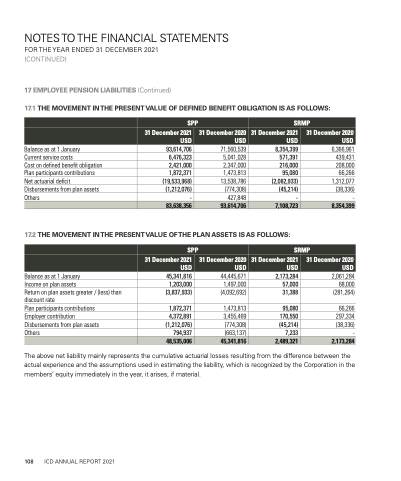

17 EMPLOYEE PENSION LIABILITIES (Continued)

17.1 THE MOVEMENT IN THE PRESENT VALUE OF DEFINED BENEFIT OBLIGATION IS AS FOLLOWS:

8,354,399 571,391 216,000

95,080 (2,082,933) (45,214) -

SPP

SRMP

31 December 2021 USD

31 December 2020 USD

31 December 2021 USD

31 December 2020 USD

Balance as at 1 January

Current service costs

Cost on defined benefit obligation

Plan participants contributions

Net actuarial deficit

Disbursements from plan assets

Others - 427,848

6,366,961 439,431 208,000

66,266 1,312,077 (38,336) -

2,061,284 68,000 (281,264)

66,266 297,334 (38,336)

-

93,614,706 71,560,539 6,476,323 5,041,028 2,421,000 2,347,000 1,872,371 1,473,813

(19,533,968) 13,538,786 (1,212,076) (774,308)

83,638,356

93,614,706

7,108,723

8,354,399

17.2 THE MOVEMENT IN THE PRESENT VALUE OF THE PLAN ASSETS IS AS FOLLOWS:

44,445,671 2,173,284 1,497,000 57,000

1,473,813 95,080 3,455,469 170,550 (774,308) (45,214) (663,137) 7,233

SPP

SRMP

31 December 2021 USD

31 December 2020 USD

31 December 2021 USD

31 December 2020 USD

Balance as at 1 January

Income on plan assets

Return on plan assets greater / (less) than

discount rate

Plan participants contributions

Employer contribution

Disbursements from plan assets

Others 794,937

45,341,816 1,203,000

(3,837,933)

(4,092,692)

31,388

1,872,371

4,372,891 (1,212,076)

48,535,006

45,341,816

2,489,321

2,173,284

The above net liability mainly represents the cumulative actuarial losses resulting from the difference between the actual experience and the assumptions used in estimating the liability, which is recognized by the Corporation in the members’ equity immediately in the year, it arises, if material.

108 ICD ANNUAL REPORT 2021