Page 112 - ICD AR21 EN

P. 112

NOTES TO THE FINANCIAL STATEMENTS FOR THE YEAR ENDED 31 DECEMBER 2021

(CONTINUED)

17 EMPLOYEE PENSION LIABILITIES (Continued)

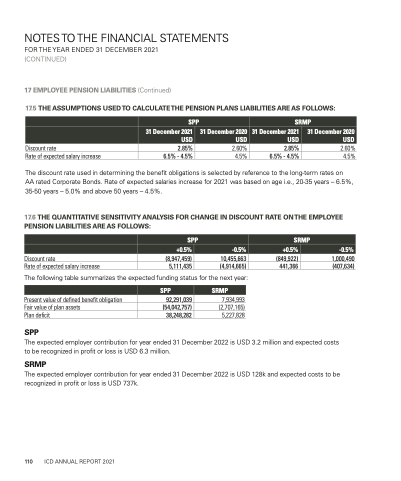

17.5 THE ASSUMPTIONS USED TO CALCULATE THE PENSION PLANS LIABILITIES ARE AS FOLLOWS:

Discount rate 2.85% 2.60% 2.85% 2.60%

SPP

SRMP

31 December 2021 USD

31 December 2020 USD

31 December 2021 USD

31 December 2020 USD

Rate of expected salary increase 6.5% - 4.5% 4.5% 6.5% - 4.5%

4.5%

The discount rate used in determining the benefit obligations is selected by reference to the long-term rates on AA rated Corporate Bonds. Rate of expected salaries increase for 2021 was based on age i.e., 20-35 years – 6.5%, 35-50 years – 5.0% and above 50 years – 4.5%.

17.6 THE QUANTITATIVE SENSITIVITY ANALYSIS FOR CHANGE IN DISCOUNT RATE ON THE EMPLOYEE PENSION LIABILITIES ARE AS FOLLOWS:

Discount rate (8,947,459) 10,455,663 (849,922) 1,000,490 Rate of expected salary increase 5,111,435 (4,914,665) 441,366 (407,634)

The following table summarizes the expected funding status for the next year:

SPP

SRMP

+0.5%

-0.5%

+0.5%

-0.5%

SPP

SRMP

Present value of defined benefit obligation Fair value of plan assets

Plan deficit

SPP

92,291,039 (54,042,757) 38,248,282

7,934,993 (2,707,165) 5,227,828

The expected employer contribution for year ended 31 December 2022 is USD 3.2 million and expected costs to be recognized in profit or loss is USD 6.3 million.

SRMP

The expected employer contribution for year ended 31 December 2022 is USD 128k and expected costs to be recognized in profit or loss is USD 737k.

110 ICD ANNUAL REPORT 2021